Memecoin News

Solana Meme Coins Lagging as Sol DeFi Trading Slows

The value of Solana-based meme coins such as BONK, DogWifHat, and Book of Meme has decreased since March. Trading activity on top decentralized exchanges on Solana has also decreased significantly in the past week. Despite these challenges, the future of Solana’s DeFi market remains promising.

Shiba Inu and Pepe, two popular meme coins, have seen an increase in the last week, while meme tokens on Solana have lost momentum after initial growth earlier this year.

BONK, which was initially popular among Solana meme coins, has seen a 40% drop from its peak in March. Book of Meme and DogWifHat, both gaining attention in March, have also faced losses and are trading at less than half of their highest prices.

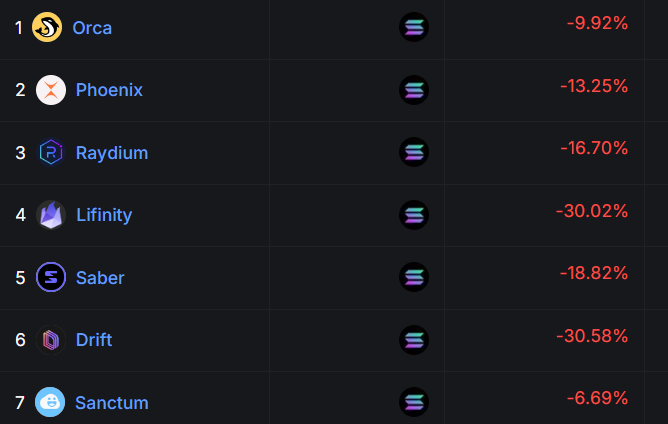

The decline in Solana tokens’ performance has affected decentralized exchanges (DeXs) on the platform. For instance, Orca, which accounts for 40% of the Solana DeFi spot trading market, has seen a 10% decrease in volume in the last week. Other leading DeXs like Pheonix, Raydium, and Lifinity have also experienced drops in volume between 13% and 30% during this period.

This slowdown in DeFi on Solana could present challenges for the blockchain’s meme coin market, but there is hope for recovery in the long run. DeFi on Solana is still in its early stages, and some obstacles are expected. Imran Mohamed, CMO of Zeta Markets, a Solana-based DeX, believes that Solana is suitable for attracting retail traders and that meme coins play a vital role in drawing retail attention.

For regular DeFi traders, meme coins like BONK and WIF offer accessible investment opportunities with potential for high returns. Mohamed anticipates these meme coins to continue playing a significant role as the Solana DeFi market expands.

In summary, the value of Solana’s meme coins and DeX volumes have faced setbacks, but there is optimism for the future of DeFi on this blockchain.