Memecoin News

Has the hype surrounding “Memecoin Mania” come to an end with a 3% increase in WIF and a 7% decrease in SHIB within 24 hours?

Despite a widespread decrease in prices for most cryptocurrencies, WIF has stood out with a surge in price and social activity compared to SHIB. While SHIB’s price dropped by over 7% in the last 24 hours, WIF’s has remained in the green. Additionally, WIF’s price has rebounded quickly following a sharp drop on April 14th, and has shown a 3% increase in the last 24 hours, unlike many other cryptocurrencies. As of now, WIF is trading at $2.81 and has a market capitalization of over $2.8 billion.

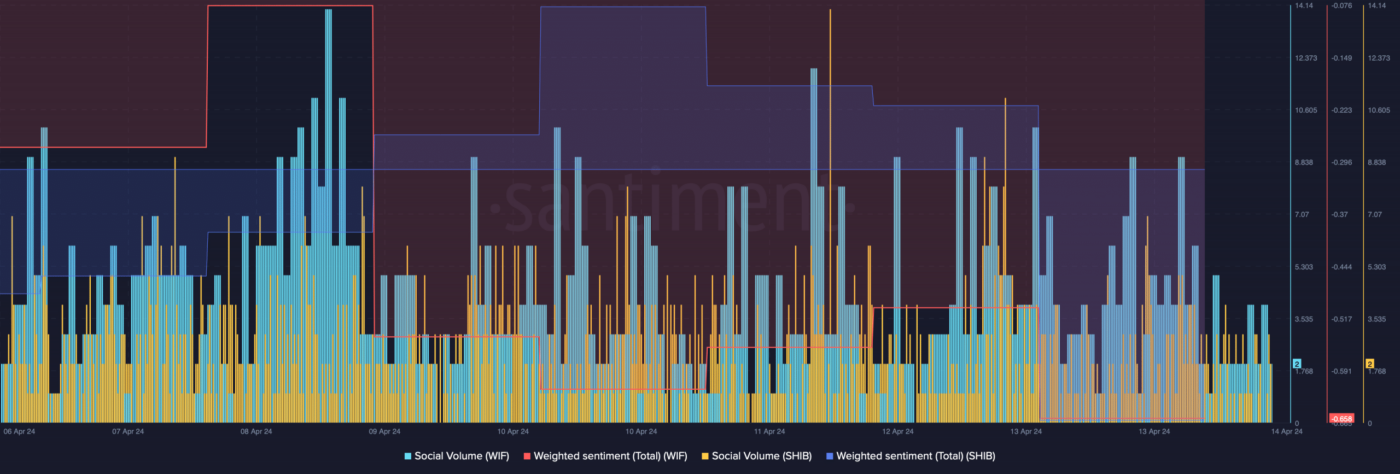

In contrast, SHIB has continued to experience a decrease in value, with a market cap of $13.15 billion and a current value of $0.00002232. WIF not only outperformed SHIB in terms of price, but also had a higher social volume according to a data analysis by Santiment for AMBCrypto.

Further analysis by AMBCrypto looked at the liquidation heatmap for WIF and predicts potential price targets if the trend continues to be bullish. Based on data from Hyblock Capital, it is possible that WIF could reach a price of $3.9. If it successfully breaks through that level, it could potentially reach $4.2 or even $4.5 in the coming weeks.

However, there is also some uncertainty surrounding WIF due to an increase in selling pressure, as reported by a recent tweet from Lookonchain stating that a whale sold 1.22 million WIF for 3.13 million USDC at $2.56.

In comparison, SHIB’s metrics do not look as promising. A data analysis by Santiment for AMBCrypto reveals a decrease in SHIB’s MVRV ratio, indicating a drop in value. Additionally, its NVT ratio has spiked, suggesting an overvaluation and potential further price decline. However, SHIB’s supply on exchanges has decreased, indicating a high demand for the cryptocurrency.

In summary, WIF has shown more positive trends in terms of both price and social volume compared to SHIB. While WIF’s rapid recovery and potential price targets are optimistic, the increase in selling pressure and metrics indicating a bearish trend raise concerns. On the other hand, SHIB’s metrics also suggest a potential price decline despite a lower supply on exchanges.