In the last 24 hours, there has been a rise in the value of meme coins and tokens connected to artificial intelligence, surpassing the gains of more well-known tokens such as bitcoin. However, these major tokens, including bitcoin, have begun to recover from their losses over the weekend and are now trading around $66,600. This rebound is said to be linked to rumors that certain companies have received approval to offer exchange-traded funds for bitcoin and ether in Hong Kong. The overall market decline was largely due to investors taking profits before the halving of bitcoin and concerns about the larger economic situation, resulting in the liquidation of over $2 billion in futures and a drop in open positions.

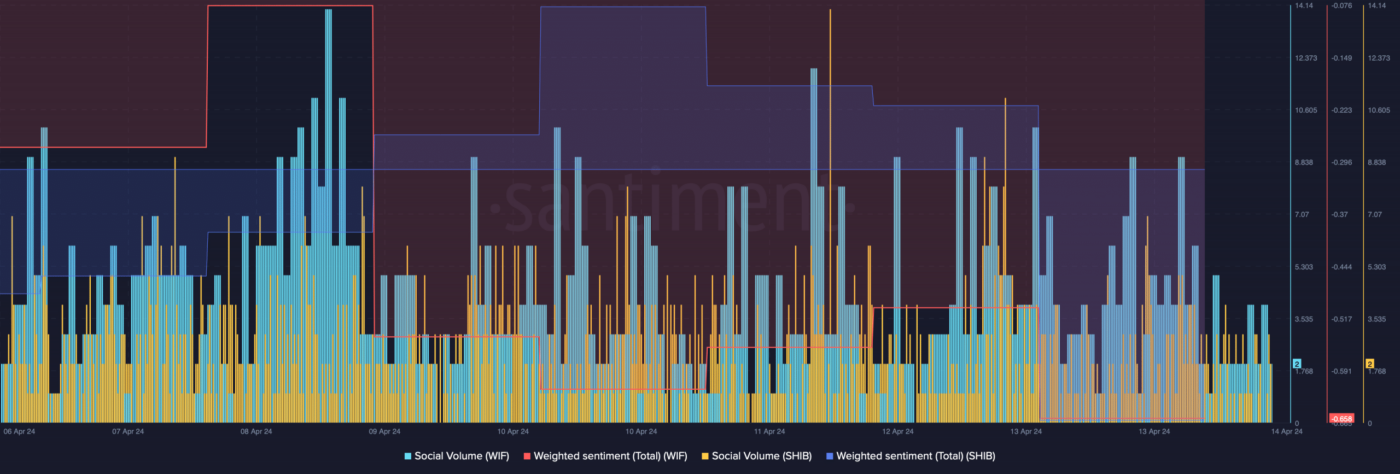

On the other hand, tokens for layer-1 blockchains like ether, Solana’s SOL, and Avalanche’s AVAX have had relatively low gains, averaging only 5.5%. The CoinDesk 20 index, which excludes stablecoins, has risen about 6%. On-chain analysis from Lookonchain shows that “whales” or big investors have purchased large quantities of meme tokens like “cat in a dogs world” (MEW) and “slerf” (SLERF), causing their prices to jump almost 80% in the past day. There doesn’t seem to be any specific cause for this sudden increase.

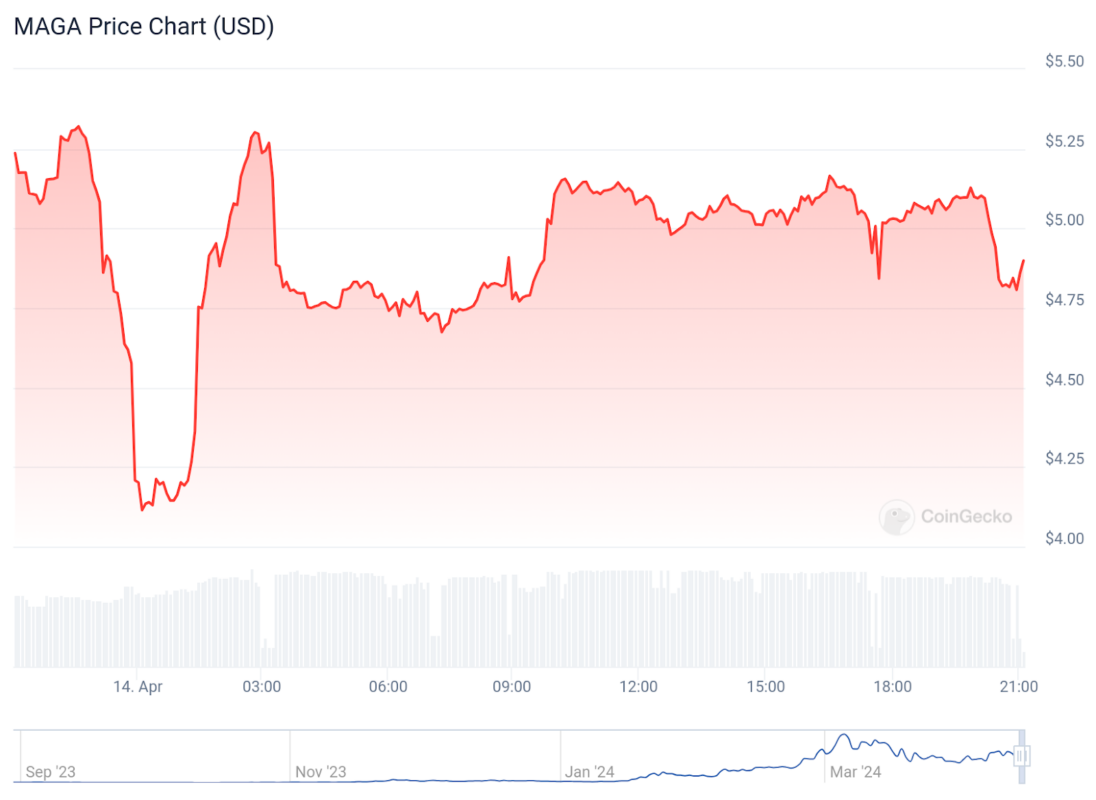

Meanwhile, the market has been negatively impacted by investors taking profits before the halving, which is expected to take place later this week, as well as concerns about the economy since Friday. Bitcoin fell from its recent high of around $70,500 to as low as $62,800, leading to a market-wide decline with major tokens losing up to 18% of their value. As a result, over $2 billion in futures were liquidated over the weekend, the highest amount since March. Data from Coinalyze shows that a majority of these positions were betting on the price of bitcoin going up.

This drop in value has also caused a decrease of $13 billion in open positions since Friday, implying that investors are closing their bets. Some traders had predicted this drop in price in anticipation of the halving, a highly-anticipated event happening on April 20 that will cut rewards for network miners in half. Matteo Greco, a research analyst at Fineqia International, has noted that while previous halving events have typically been followed by an overall upward trend, they have also led to short-term price fluctuations before and after the event. This current negative sentiment is reflected in the net outflow of $85 million from Bitcoin Spot ETFs this week, indicating that investors are taking profits and being cautious following strong gains in the fourth quarter of 2023 and first quarter of 2024.